What is non-custodial ETH Staking

ETH is the commodity used to pay for value-based Internet services. By staking ETH, you get access to ETH rewards in exchange for your Validator’s work and supporting the growth of the Ethereum network

Validating the Ethereum network

Staking can refer to many mechanisms, here we are referring to the mechanism that grants a network participant the ability to act as a Validator for the Ethereum blockchain by staking ETH.

Non-custodial staking, in increments of 32 ETH, allows the asset owner to always retain full control.

Participating in the Ethereum staking economy is a public good and rewards participants for securing the Ethereum network, and further supporting Ethereum decentralisation.

Generating ETH Rewards

This staked ETH allows the Validator to participate in consensus-related duties on the Beacon Chain, making it accountable for breaking any rules in the protocol. By performing these duties in a timely and correct manner, the validator can earn rewards in ETH.

Evolving Ethereum Roadmap

Staking to become a Validator for Ethereum began in November 2020. Evolving to Proof-of-Stake, courtesy of the Paris hard fork (The Merge) in September 2022, at epoch 146875, and graduated to liquid Staking with the Shapella hard fork in April 2023, which combined changes to the execution layer (Shanghai), consensus layer (Capella) and the Engine API, at epoch 194048 / block number 17034870 .

Today, approximately USD $33,352,445,385 worth of ETH is staked on Ethereum.

The staking ratio of ETH is currently 15.62% of the circulating supply.

Non-custodial ETH Staking ensures that custody always remains with the client. With support for leading custodial solutions such as Fireblocks, MetaMask Institutional, BitGo, Zodia, SAFE, Ledger, and a host of other solutions, including Wallet Connect.

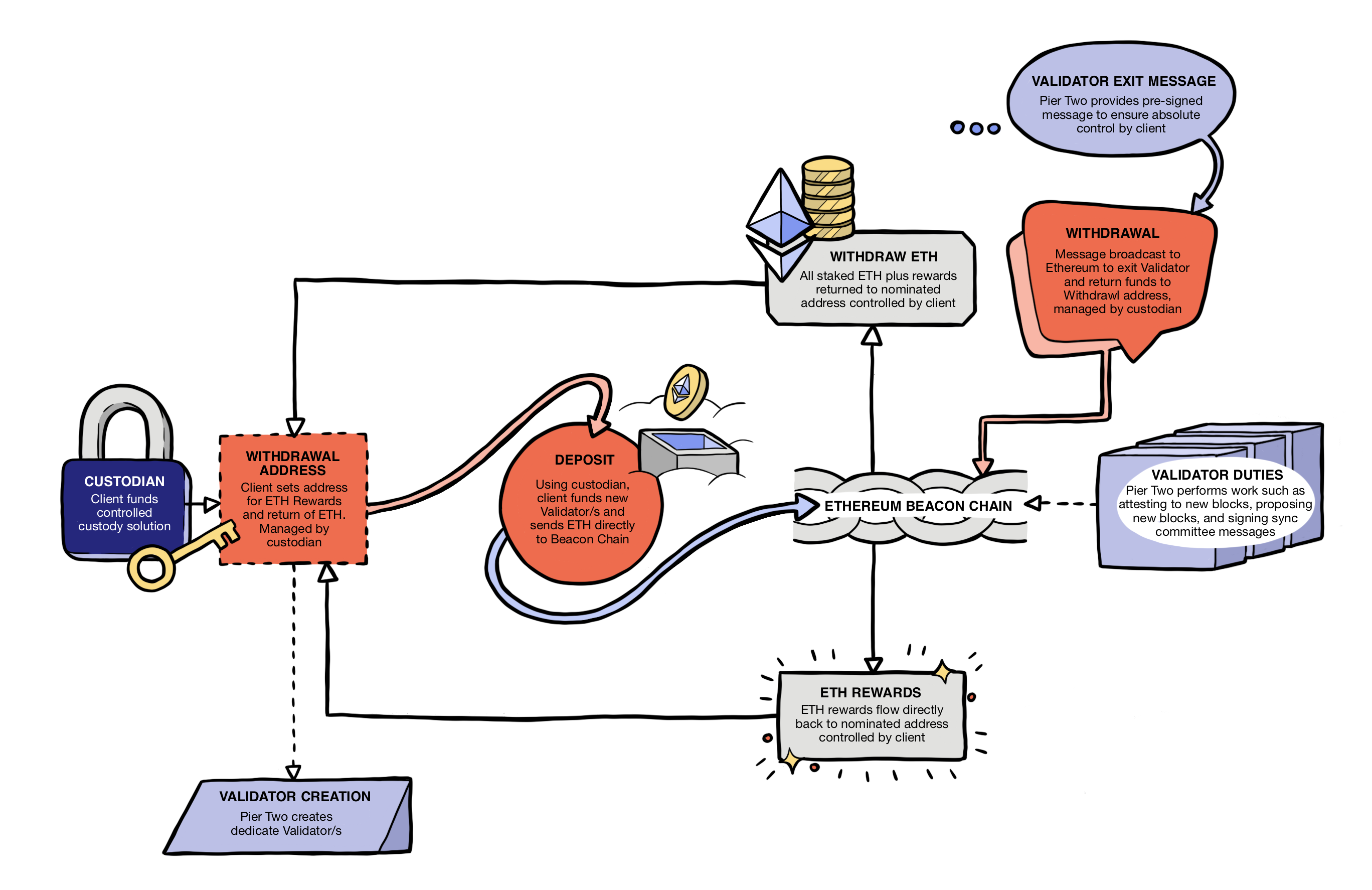

Pier Two is assigned a role to provide validator services, performing the duties required by Ethereum, such as attesting to new blocks, proposing new blocks and signing sync committee messages when selected. All without ever accessing client controlled assets.

All ETH rewards for performing these duties flow directly to the Withdrawal address and/or Fee Recipient address controlled by client custodial wallets.

Validator performance and rewards are all visible on the Ethereum blockchain, holding parties to account, and allowing efficient selection in staking service providers. Clients can exit validators at any time, without action required by the staking service provider. At which point the validator will cease to perform duties, and deposited ETH enters a queue to be returned directly to the client's Withdrawal address, from Ethereum's beacon chain.

After the Merge, when Ethereum switched the consensus mechanism from proof-of-work to proof-of-stake, Ethereum substituted energy and compute for staked ETH. It is estimated that Ethereum's energy consumption is approximately ~0.0026 TWh/yr across the entire global network. This naturally changes as validators enter and leave the network, and can be tracked using a rolling 7-day average estimate by the Cambridge Blockchain network Sustainability Index . While energy estimates are complicated, more information is available on the Ethereum website .