Unlocking Staking Potential in a Cold Storage World

Japan’s 2023 amendments to the Payment Services Act(Act No. 59 of 2009) (PSA) introduced strict requirements for crypto asset management, including the mandate that at least 95% of user assets be held in offline, cold wallets. While these rules prioritise security, they also present challenges for institutions looking to generate staking rewards without moving assets online.

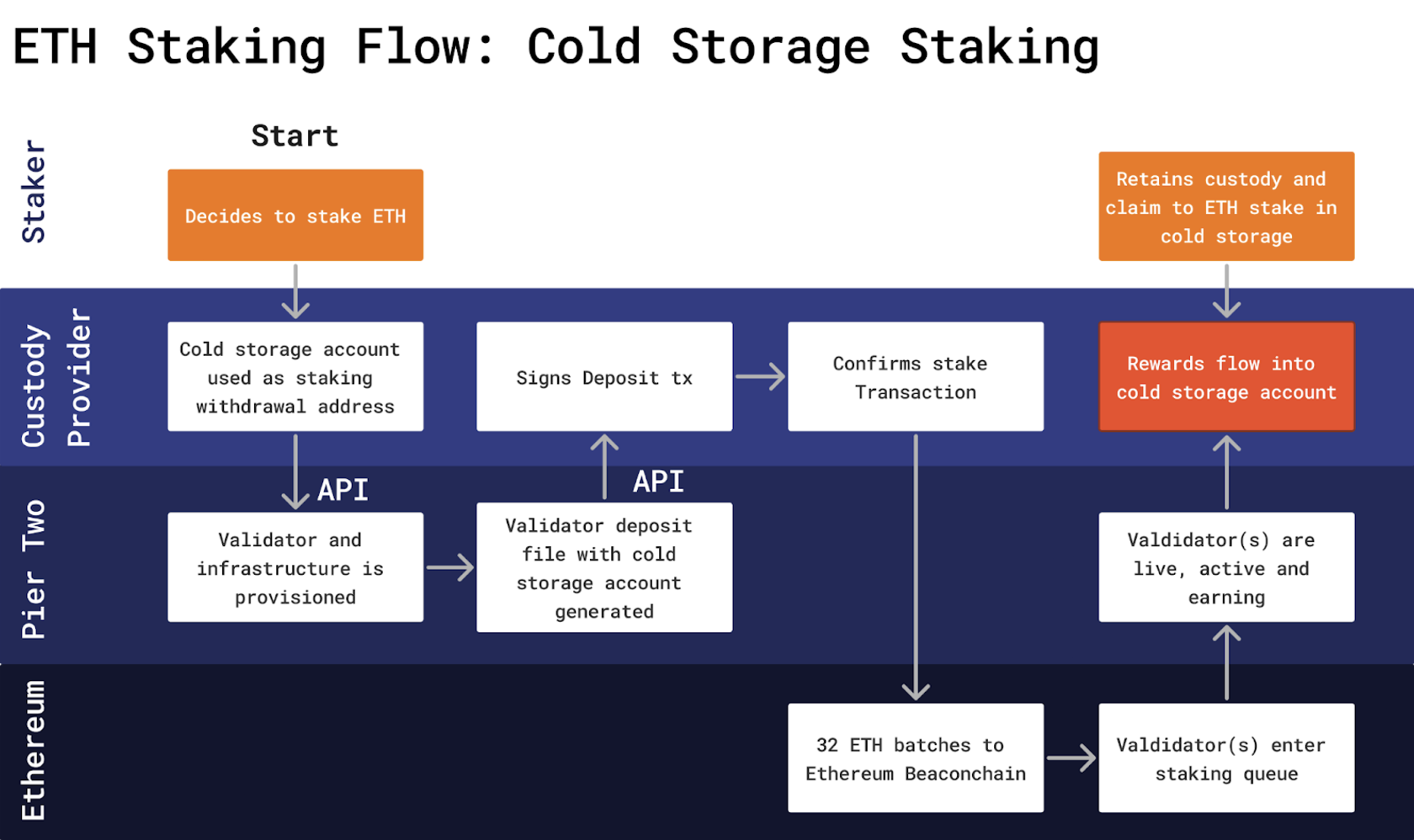

Pier Two, working with leading cold storage custody providers, offers a solution that allows institutions to stake directly from cold wallets. This innovative approach enables compliant staking without compromising security or operational efficiency.

The Challenge: Staking Under PSA Cold Wallet Rules

The PSA requires Crypto Asset Exchange Service Providers (CAESPs) to manage assets securely and provides for:

- a cold wallet mandate where at least 95% of user assets must be kept offline; and

- a redemption guarantee of assets where any assets moved online (hot wallets) requires CAESPs to match them with an equivalent amount in cold wallets.

Traditional staking methods often require assets to be moved to online hot wallets, exposing them to security risks and creating stranded capital burdens. For institutions, this introduces unnecessary complexity and costs while reducing compliance efficiency.

Pier Two’s Solution: Staking Directly from Cold Storage

Pier Two, through your chosen custody partner, enables institutions to stake Ethereum (ETH) and other assets directly from cold storage wallets, eliminating the need to transfer funds to hot wallets. This approach is fully compliant with PSA regulations and offers several advantages:

- Where assets maintain offline security and staked assets remain in air-gapped cold wallets throughout the staking process, minimizing exposure to online risks;

- You achieve simplified compliance and avoid the need for Redemption Guarantee Asset requirements, reducing operational and financial burdens; and

- More seamless operations allow for assets to be unstaked and returned to cold wallets without private keys ever being brought online.

This solution empowers CAESPs to meet regulatory demands while continuing to generate staking rewards for their users efficiently.

A Closer Look at the Staking Workflow

Pier Two’s staking-from-cold-storage solution combines innovative technology with practical compliance measures such as:

- cold storage custody integration, where your assets remain in offline, air-gapped wallets managed by trusted custody providers;

- policy enforcement, which provides Cryptographically secured policies to govern all staking operations, ensuring compliance with PSA requirements;

- offline transaction signing that allows transactions to be pre-approved and signed offline using cold storage keys; and

- secure broadcasting of signed transactions that are broadcast to the blockchain through an online counterpart without exposing the private keys.

This streamlined process eliminates unnecessary asset movements.

Transforming Staking for Japan’s Institutions

Pier Two’s solution redefines what’s possible for staking under Japan’s PSA. By enabling institutions to keep assets offline while earning staking rewards, Pier Two ensures:

- uncompromised security, your assets never leave cold storage, maintaining the highest level of protection;

- operational efficiency by reducing complexity by removing the need for hot wallet transfers and matching guarantees; and

- regulatory compliance, with a staking solution that was developed to align with FSA standards for crypto asset management in Japan.

Ready to Stake from Cold Storage?

Pier Two is preparing for how institutions in Japan approach staking under the PSA regulations. Our solutions unlock the potential of digital assets with a mind toward security and compliance.

Contact us today to learn how Pier Two can help your institution meet PSA requirements and achieve your staking goals.